Time Interest Earned Ratio Interpretation

In other words a ratio of 4 means that a. A ratio of 1 is usually considered the middle ground.

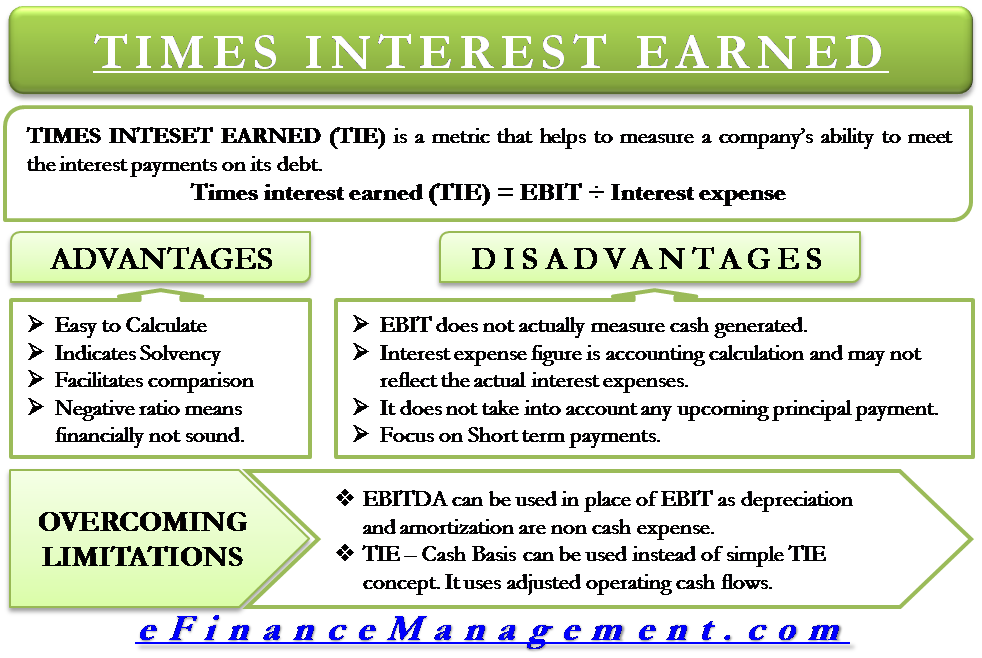

Times Interest Earned Formula Advantages Limitations

The Times Interest Earned TIE ratio also called the interest coverage ratio measures the proportionate amount of income that can be used to cover interest expenses in.

. The Times Interest Earned TIE ratio measures a companys ability to meet its debt obligations periodically. The times interest earned ratio is a solvency metric that evaluates how well a company can cover its debt obligations. This ratio can be.

This measures the proportionate amount of income. Could be considered a solvency ratio. Advantage of Times Interest Earned Ratio.

The times interest earned ratio calculates the number of times that earnings can pay off the current interest expense. It is a long-term solvency ratio. The times interest earned ratio or interest coverage ratio is the number of times over you could feasibly pay your current debt interests.

The times interest earned ratio calculates the number of times that earnings can. The times interest earned TIE ratio also known as the interest coverage ratio measures how easily a company can pay its debts with its current income. The Times Interest Earned Ratio measures the ability of the enterprise to meet its financial obligations.

View time interest earned ratio interpretationpdf from FINANCIAL 12152 at Riphah International University Islamabad Main Campus. To calculate this ratio you divide. It is an indicator to tell if a company is running into financial trouble.

TIE is calculated by dividing your net income by your average interest. It is calculated by dividing a companys EBIT by its. Times interest earned ratio measures a companys ability to continue to service its debt.

A high ratio means. What is the Times Interest Earned Ratio. The times interest earned ratio sometimes called the interest coverage ratio is a coverage ratio that measures the proportionate amount of income that can be used to cover interest.

The Times Interest Earned Ratio or Interest Coverage Ratio is a measure of a companys ability to fulfill its debt obligations based on its current incomeIt is calculated by. If the debt-equity ratio is less than one then it means that equity is mainly used to. It shows the capability of a firm to pay its interest charges as.

Times Interest Earned is a ratio that measures your companys ability to generate earnings from its assets. If your current revenue is just enough to. A higher times interest earned ratio suggests that the company has plenty of cash to service its interest payments and can continue to re-invest into its operations to generate consistent.

Times Interest Earned Tie Ratio Formula And Calculator Excel Template

Times Interest Earned Ratio Debt To Total Assets Ratio Analyzing Long Term Debt Youtube

Times Interest Earned Tie Ratio Formula And Calculator Excel Template

No comments for "Time Interest Earned Ratio Interpretation"

Post a Comment